In an era where digital finance is rapidly transforming how we manage our money, Uganda is not being left behind. The rise of mobile money services and fintech innovations has created numerous opportunities for Ugandans to save, invest, and manage their finances more efficiently. Here are the top five money-saving apps making waves in Uganda for 2024.

1. Chipper Cash

Chipper Cash has steadily gained popularity across Africa, including Uganda, due to its simplicity and cost-effectiveness. It is primarily known for its fee-free money transfers, but its capabilities extend beyond that, making it an excellent tool for saving money.

Features:

- Free Money Transfers: One of Chipper Cash’s biggest selling points is its zero-fee transactions, which means users can send money domestically and across borders without incurring charges.

- Investments: The app offers users the ability to invest in US stocks from as low as $1, making it accessible for everyday Ugandans to start building their investment portfolio.

- Chipper Card: A virtual card that allows users to make online purchases and manage their spending more efficiently.

- User-Friendly Interface: The app’s design is intuitive, making it easy for users to navigate and manage their finances.

Why It’s a Top Choice: Chipper Cash is ideal for individuals looking to save on transaction fees while having the option to grow their savings through investments. Its cross-border functionality is particularly beneficial for those with family or business connections in other African countries.

2. SafeBoda Wallet

SafeBoda, originally known for its motorcycle ride-hailing services, has expanded its platform to include a digital wallet that is rapidly becoming popular among Ugandans for its convenience and money-saving features.

Features:

- Cashback and Discounts: Users earn cashback on every transaction made through the SafeBoda app, including rides, food deliveries, and more.

- Savings Feature: The app has a dedicated savings feature that encourages users to set aside money regularly. Users can set savings goals and track their progress easily.

- Bill Payments: SafeBoda Wallet allows users to pay for utilities, airtime, and other services directly from the app, often with discounts or promotional offers.

- Integration with SafeBoda Services: Seamless integration with SafeBoda’s transportation and delivery services makes it a one-stop-shop for various daily needs.

Why It’s a Top Choice: SafeBoda Wallet is perfect for individuals looking to save on everyday expenses while enjoying the convenience of a multi-service platform. The cashback and savings features are particularly attractive for frequent users of the app’s services.

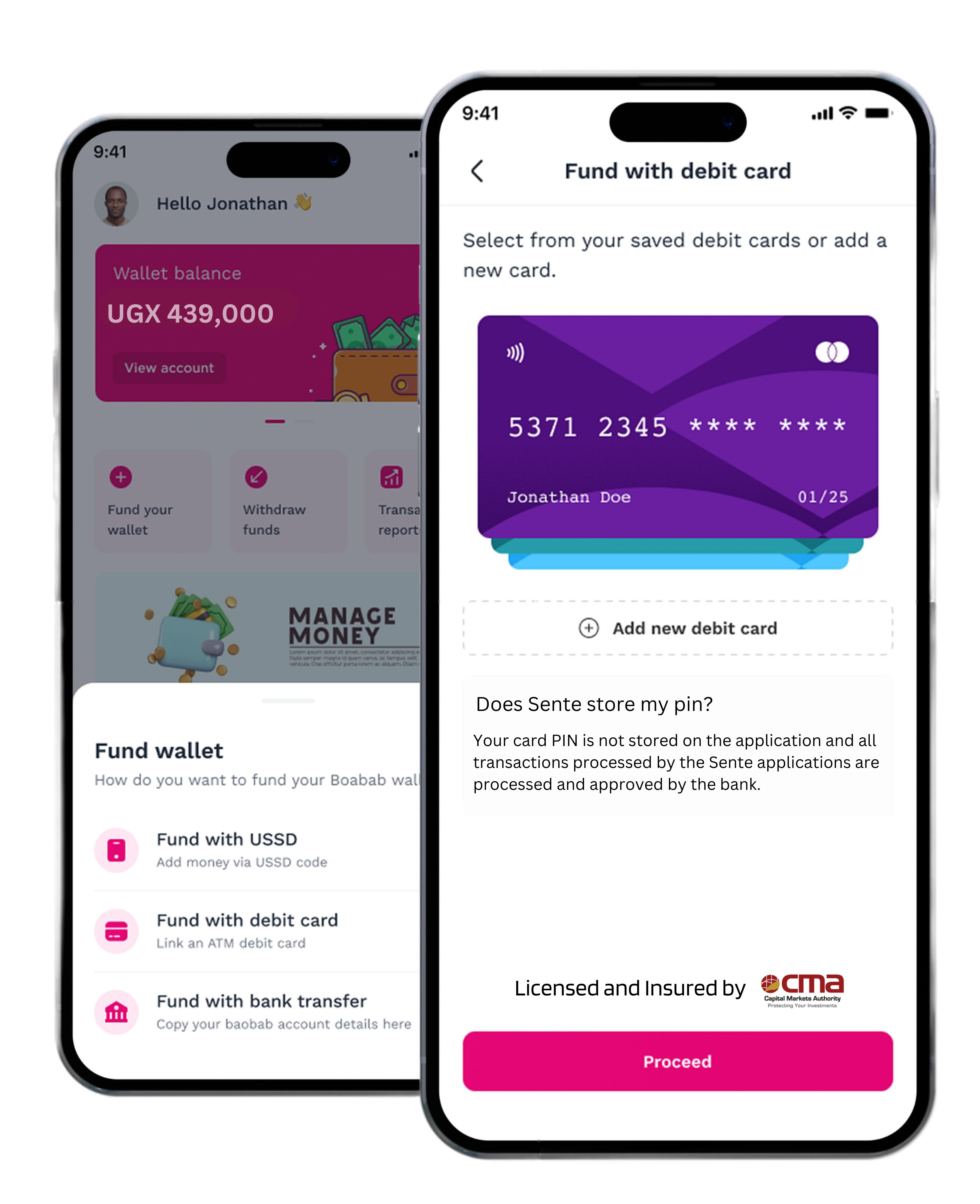

3. Sente

Sente is another innovative money-saving app that has garnered attention in Uganda for its robust features tailored to meet the financial needs of its users.

Features:

- Savings Goals: Sente allows users to set and track savings goals, encouraging disciplined saving habits.

- Microloans: The app provides access to microloans, helping users manage short-term financial needs without exorbitant interest rates.

- Expense Tracking: Users can track their expenses, helping them understand their spending patterns and identify areas where they can save.

- Secure Transactions: Sente ensures all transactions are secure, giving users peace of mind when managing their finances through the app.

- Automated Investing: Sente creates personalized investment portfolios based on users’ financial goals, risk tolerance, and time horizon.

- Goal-Based Saving: Users can set specific financial goals, such as education, retirement, or a major purchase, and Sente will help them create a plan to achieve these goals.

- Low Fees: The platform offers low management fees, making it affordable for users to start investing with small amounts of money.

- Educational Resources: Sente provides a wealth of educational resources to help users make informed financial decisions.

Why It’s a Top Choice: Sente is perfect for users who want a comprehensive tool for managing their savings, tracking expenses, and accessing short-term credits. Sente is ideal for individuals looking to grow their savings through strategic investments. Its personalized approach to portfolio management and goal-based saving makes it a powerful tool for long-term financial planning.

Conclusion

As the financial landscape in Uganda continues to evolve, these top five money-saving apps—Chipper Cash, SafeBoda Wallet, Sente—offer innovative solutions to help users manage their finances more effectively. Whether it’s through fee-free transfers, cashback on everyday transactions, multi-currency management, secure savings, or strategic investments, these apps are empowering Ugandans to save and grow their money in 2024.

One thought on “Top 3 Best Money Saving Apps in Uganda For 2024”

Comments are closed.

Nice one