What you need to know:

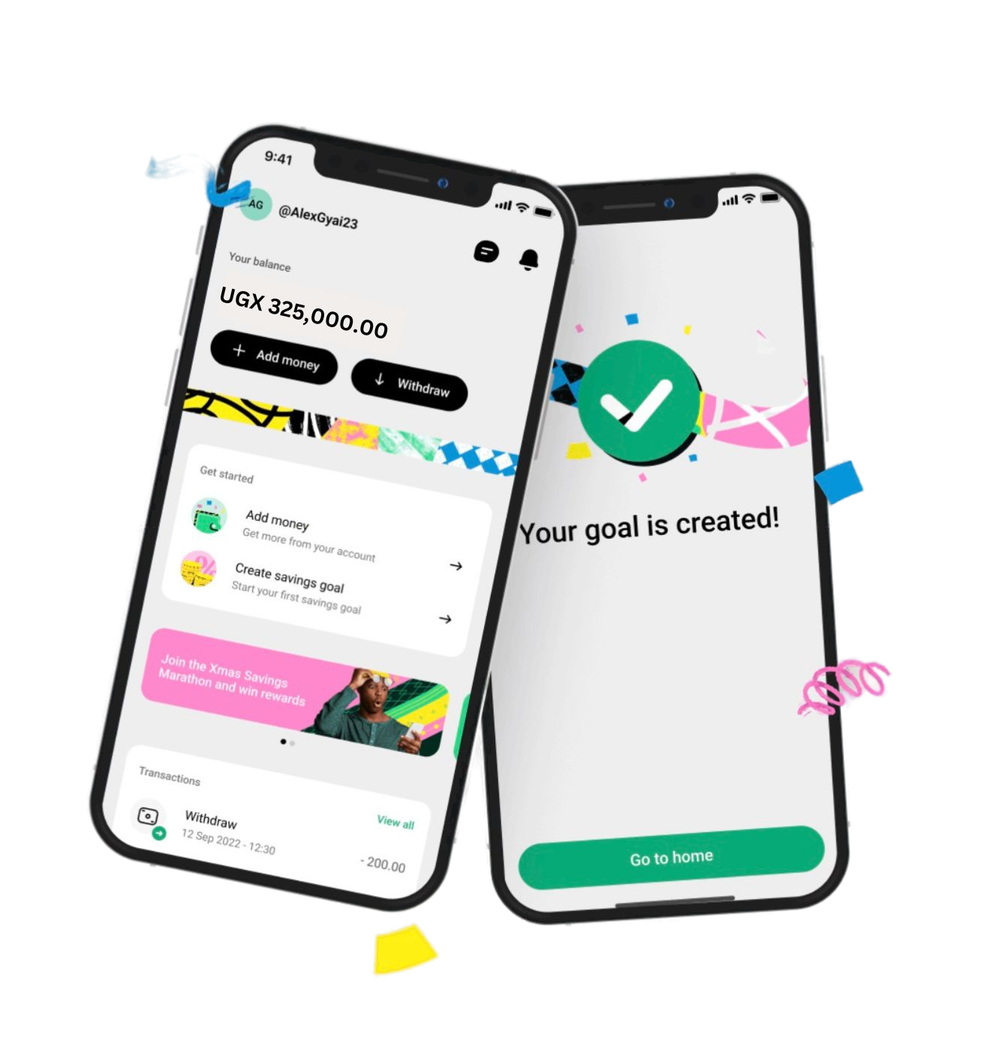

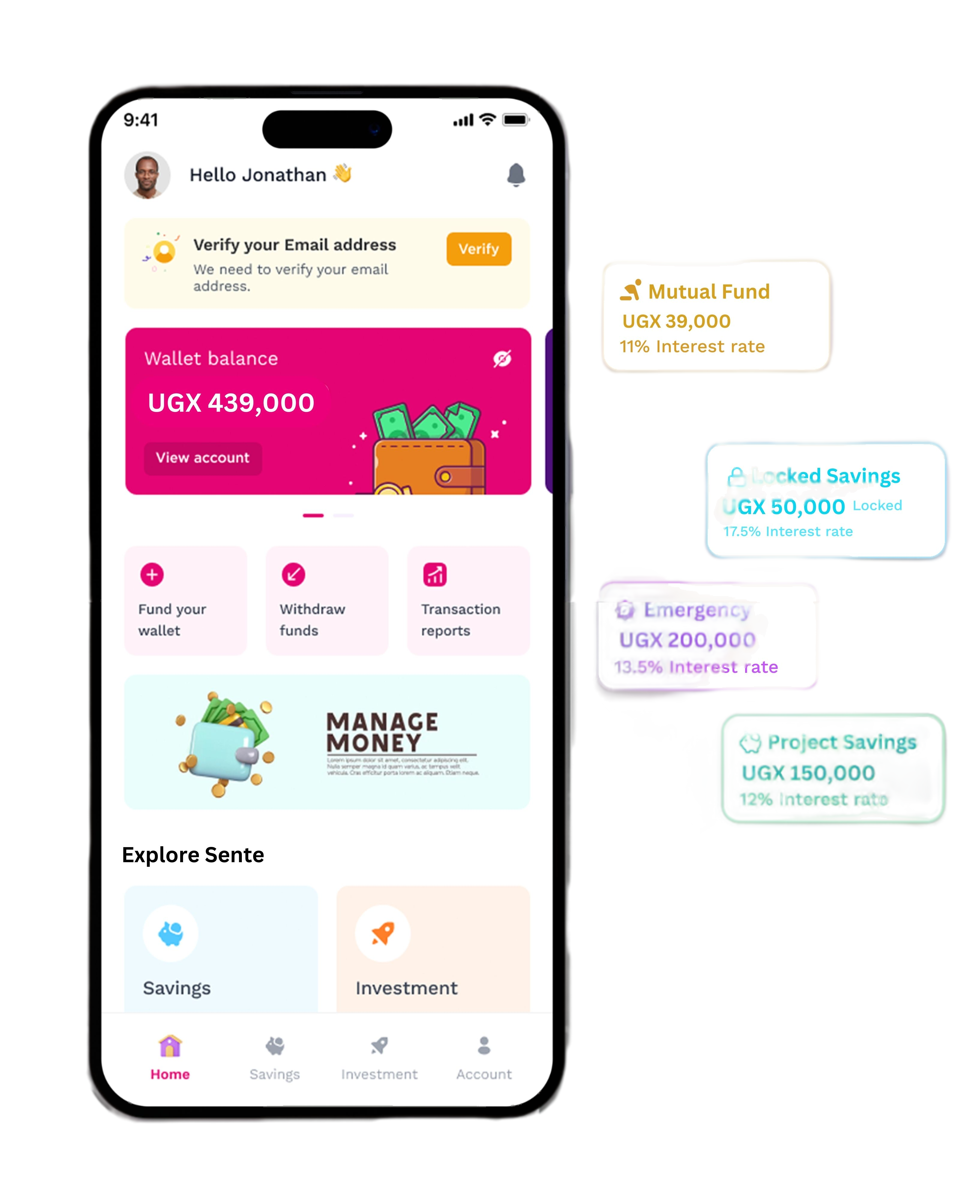

- Sente Uganda is an app that enables anyone with a mobile money account to create financial goals as an individual or as a group, invest their money towards these goals, track progress, and earn interest.

Sente Uganda’s chief executive, says the app will be available for download from Google Play and Apple App Stores or use it directly via the Web App platform.

Authorized under the Capital Markets Authority fintech sandbox, the app will send prompts to users to invest towards their goals and offer advice on investing based on their spending habits.

Ugandans can now save as little as five shillings on their mobile phones thanks to this new platform.

Sente Uganda is designed to help individuals and groups create saving goals, invest their money towards these goals, and track their progress while earning interest.

Once users register, they can create saving goals and begin their investment journey. Sente Uganda app provides investment prompts and advice tailored to the user’s spending habits.

Research indicates Ugandans have a “self-imposed” limitation, believing they can only save larger amounts, typically UGX 50,000 and above.

“Our journey in Sente Uganda began when we noticed Uganda has numerous lending apps fostering a consumerism culture but limited investment solutions,” the CEO said.

By investigating why customers weren’t embracing investment options in Uganda’s developing market, several insights emerged.

“Most people are unbanked or under-banked, requiring more time and effort to invest. Additionally, the financial sector’s heavy use of investment jargon discourages potential investors,” he noted.

“Current solutions also lack engagement methods like feedback mechanisms, social nudges, and reminders to save and invest.”

The research also revealed that many Ugandans are unaware of accessible investment channels that allow easy tracking with minimal friction in terms of time and financial cost.

“With mobile money being widely used, a comprehensive saving and investment solution on phones seemed necessary, which inspired the development of Sente Uganda.”

He also pointed out that while many Ugandans wish to invest, psychological barriers such as lack of commitment, being overwhelmed by expenses, and a tendency to choose immediate gratification over saving hinder their efforts.

“The platform allows users to invest as little as UGX 5,000 to cultivate a savings culture, much like using piggy banks to nurture saving habits,” he noted.

For those struggling to save and invest, the Sente Uganda app employs AI algorithms and data analytics to guide users on investment amounts based on their spending habits. For instance, after dining at a restaurant, the app might suggest a specific savings amount. Users can also invest with family and friends and benefit from behavioral psychology practices such as social nudges, default bias, and self-commitment to bridge the gap between intention and action.

He emphasized that bridging this gap is crucial for accelerating economic growth.

“Through Sente Uganda, we aim to help Ugandans achieve aspirations like education, travel, and homeownership. Our partnership is based on one goal: to democratize investment by providing access to opportunities with competitive returns.”